Containment domes or shell game? (Aerial view of San Onofre Nuclear Generating Station by Jelson25 via wikipedia)

Southern California Edison (SCE), the operator of the troubled San Onofre Nuclear Generating Station (SONGS), has proposed to restart one of the facility’s two damaged reactors without repairing or replacing the parts at the root of January’s shutdown. The Thursday announcement came over eight months after a ruptured heat transfer tube leaked radioactive steam, scramming Unit 3 and taking the entire plant offline. (Unit 2, offline for maintenance, revealed similar tube wear in a subsequent inspection; Unit 1 was taken out of service in 1992.)

But perhaps more tellingly, Edison’s plan–which must be reviewed by the Nuclear Regulatory Commission–was issued just weeks before the mandated start of hearings on rate cuts. California law requires an investigation into ratepayer relief when a facility fails to deliver electricity for nine months. Support of the zombie San Onofre plant has cost California consumers $54 million a month since the shutdown. It has been widely believed since spring that Unit 3 would likely never be able to safely generate power, and that the almost identical Unit 2 was similarly handicapped and would require a complete overhaul for its restart to even be considered.

Yet, calls for more immediate rate rollbacks were rebuffed by Edison and ignored by members of the California Public Utilities Commission (CPUC). Despite studies that showed SONGS tube wear and failure was due to bad modeling and flawed design, and a company pledge to layoff of one-third of plant employees, San Onofre’s operators claimed they were still pursuing a restart.

Thursday’s proposal for that restart does not directly engage any of the concerns voiced by nuclear engineers and watchdog groups.

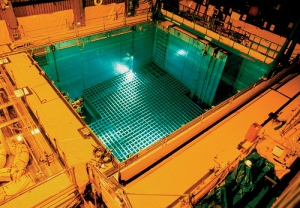

When SONGS installed new turbines in 2010 and 2011, it did not replace “like with like”–that would have required a costly custom machining of parts no longer routinely manufactured. Instead, San Onofre’s owners moved to “uprate” their generators–cramming in more transfer tubes to increase output–with the nuclear industry equivalent of “off the shelf” parts. It was a transparently profit-driven decision, but more crucially, it was a major design change that should have required a lengthy license-amendment process at the NRC.

Federal regulators, however, took on faith industry assurances that changes were not that big a deal, and approved San Onofre’s massive retrofit without an extensive investigation into the plan.

What is now understood to have happened is that the design of new parts for San Onofre was based on flawed computer models that failed to anticipate new fluid dynamics, increased vibration, and more rapid wear in the numerous thin, metal, heat transfer tubes. It’s a flaw that presumably would have turned up in a more rigorous regulatory review, and, again, a problem not directly addressed by Edison’s restart plan.

Rather than repair or replace the tubes and turbines, San Onofre’s owners propose to simply plug the most severely degraded tubes in Unit 2 and then run that reactor at 70 percent power. After five months, Unit 2 would be shut down and inspected. (There was no plan offered for the future of Unit 3.)

Why 70 percent? Edison said it believes that would lessen vibration and decrease the rate of wear on the heat transfer tubes. Does that make any scientific sense? Not in the eyes of nuclear engineer Arnie Gundersen, who has produced three studies on San Onofre’s problems:

Restarting San Onofre without repairing the underlying problems first turns Southern California into a massive science experiment. Running at the reactor at a 30 percent reduction in power may not fix the problems but rather make them worse or shift the damage to another part of the generators. It’s a real gamble to restart either unit without undertaking repairs or replacing the damaged equipment.

S. David Freeman, former head of the Los Angeles Department of Water and Power, as well as the Tennessee Valley Authority, and now a senior advisor to Friends of the Earth, is even more pointed:

Neither of the reactors at San Onofre are safe to operate. While Edison may be under financial pressure to get one up and running, operating this badly damaged reactor at reduced power without fixing or replacing these leaky generators is like driving a car with worn-out brakes but promising to keep it under 50 miles an hour.

That is the scenario now before the NRC. An experimental roll of the dice within 50 miles of 8.4 million California residents, offered up with a “trust us” by the same folks who got the modeling dangerously wrong last time, versus multiple studies calling into question the viability of a plant that already has a long history of safety and engineering problems. Regulators are at least talking as if they understand:

“The agency will not permit a restart unless and until we can conclude the reactor can be operated safely,” NRC Chairman Allison Macfarlane said. “Our inspections and review will be painstaking, thorough and will not be rushed.”

The right words, but hardly reassuring ones given the commission’s past actions (or inactions) on San Onofre and numerous other dangerous events across the nation’s aging nuclear fleet.

The sting that keeps on stinging

But does NRC approval really matter to Southern California Edison, at least in the short run?

Operating only one of San Onofre’s reactors at two-thirds of its proposed output for five months sometime next year–which is the best-case scenario–does not provide a meaningful addition to California’s near- or long-term energy outlook. (California officials are already making plans for another year without San Onofre.) In addition, San Onofre has other problems to address, such as aforementioned staffing issues, new seismic evaluations required in the wake of the Fukushima disaster, newfound safety lapses, and ongoing concerns about the quality of the concrete used to plug 28-foot holes in both reactors’ containment domes (the holes were cut for installation of the new turbines, inquiries about the strength and durability of the concrete were made a year ago, but, to date, the NRC has not released a report).

But Thursday’s proposal does provide Edison with a modicum of cover going into an October 9 public information session and the upcoming debate over whether California consumers should still have to pay for a power plant that provides no power.

Indeed, billing for services not rendered could be considered a profit center for the US nuclear industry. San Onofre is but one case; ratepayers in Florida are also familiar with the scam.

The same day SCE submitted its SONGS plan, attorneys for the Florida Public Service Commission (PSC), Progress Energy and Florida Power & Light (FPL), appeared before the Florida Supreme Court to defend an “advance fee” that has allowed the utilities to soak Sunshine State ratepayers for upwards of $1 billion. The money collected, and additional fees approved last year by the PSC, are slated for the construction of new nuclear reactors in Levy County and at Turkey Point.

The court challenge was brought by the Southern Alliance for Clean Energy, which contends there is little evidence Progress or FPL can or ever really intend to build the new facilities. Indeed, FPL has spent some of its takings on existing operations, while Progress has blown hundreds of millions of dollars trying to repair its Crystal River nuclear plant, which has been offline since 2009, and likely will never return to service.

What do attorneys for the utilities say when challenged on these points? That their intent is borne out by the fact that both are still seeking construction and operating licenses from the Nuclear Regulatory Commission.

There is no indication NRC approval on those projects is imminent (in fact, no NRC approvals of any projects are imminent), nor are there any guarantees that the projects could be fully financed even with licenses and all that ratepayer cash.

But, be it for future fantasies or current failures, from Florida to California, electricity consumers are paying higher prices to perpetuate the myth of a nuclear renaissance and balance the books of the nuclear industry. . . while industry officials, lobbyists and favored politicians pocket a healthy share.

And not satisfied with that cushy arrangement, San Onofre’s operators are also pushing for permission to move its ratepayer-financed decommissioning fund into riskier investment properties. The industry promises this will bring higher yields, but, of course, it also chances bigger losses–and it guarantees larger fees, which would be passed on to Southern California consumers upon CPUC approval.

None of these actions–not the investment games, the rate hikes or the experiment with San Onofre’s damaged reactor–are actually about providing a steady supply of safe, affordable energy. These are all pecuniary plays. Across the country and across the board, nuclear operators seem more interested in cashing in than putting out.

More prudent for governments and utility commissions, and more beneficial for ratepayers, of course, would be to stop paying the vig to nuclear’s loan sharks, stop throwing good money after bad in a sector that is dying and dangerous, and start making investments in truly clean, truly renewable, and increasingly far more economical 21st Century energy technologies.

Until that happens, the most profitable thing about nuclear power will continue to be the capacity to charge for a service that might never be provided. Private utilities have understood this for a long time; ratepayers are becoming painfully aware of it, too. The question is, when will government regulators and utility commissions understand it–or at least fess up to being in on the con?

* * * *

Stop the Madness! Or at least learn more about it. Join me on Saturday, October 13, at 5 PM Eastern time (2 PM Pacific) when I host an FDL Book Salon chat with Joseph Mangano, author of Mad Science: The Nuclear Power Experiment.

You must be logged in to post a comment.